what is a VP finance (large enterprise)?

Companies have access to a range of financial resources and handle huge cash flows. Hence, they require a VP finance (large enterprise) to distribute and manage the finances. As a VP finance (large enterprise), you oversee an organization's finances. You ensure the company's financial health by managing investment activities and developing the organization's long-term financial goals.

As a VP finance (large enterprise), you are responsible for budget planning and distributing financial resources to various departments. You also offer advice to the executive management, helping them make the best business decisions for the company. Most of your duties revolve around presenting financial reports and offering insights into financial decisions made by the company, which requires analytical ability and exceptional communication skills.

While your main role is to monitor the company’s finances, you also analyze data on investment activities to ensure the organization is getting returns. You should also be familiar with the financial requirements of your company. For instance, in the public sector, you require expertise in government appropriations, while in other industries, you need knowledge of tax laws.

Would working as a VP finance (large enterprise) suit your analytical and investigative skills? Then read on to find out what competencies and qualifications you need to thrive in a VP finance (large enterprise) role.

view jobsaverage VP finance (large enterprise) salary

According to Job Bank, the average salary of a VP finance (large enterprise) is $130,870 per year. In an entry-level position, your salary starts at $90,756 annually, while experienced VP finance (large enterprise) take home over $196,772 yearly.

what factors affect the salary of a VP finance (large enterprise)?

As a VP finance (large enterprise), your earnings depend on your position in the company and the responsibilities involved. In large organizations, VPs finance (large enterprise) are in charge of substantial resources. You could be the VP finance (large enterprise) of one division or supervise the financial resources of the entire company. When you are the chief finance manager, you earn more due to the complexity of your duties. Holding an executive position also comes with additional benefits that boost your earnings.

The industry you work in also influences your earnings. When you work in the government sector, your salary depends on your responsibilities and the size of the institutions you manage. VPs finance (large enterprise) in the private sector generally earn higher salaries.

Your salary is also based on your educational qualifications and work experience. As an assistant finance manager, you earn a lower salary, which improves as you gain experience. Improving your qualifications with professional certifications also increases your earning potential.

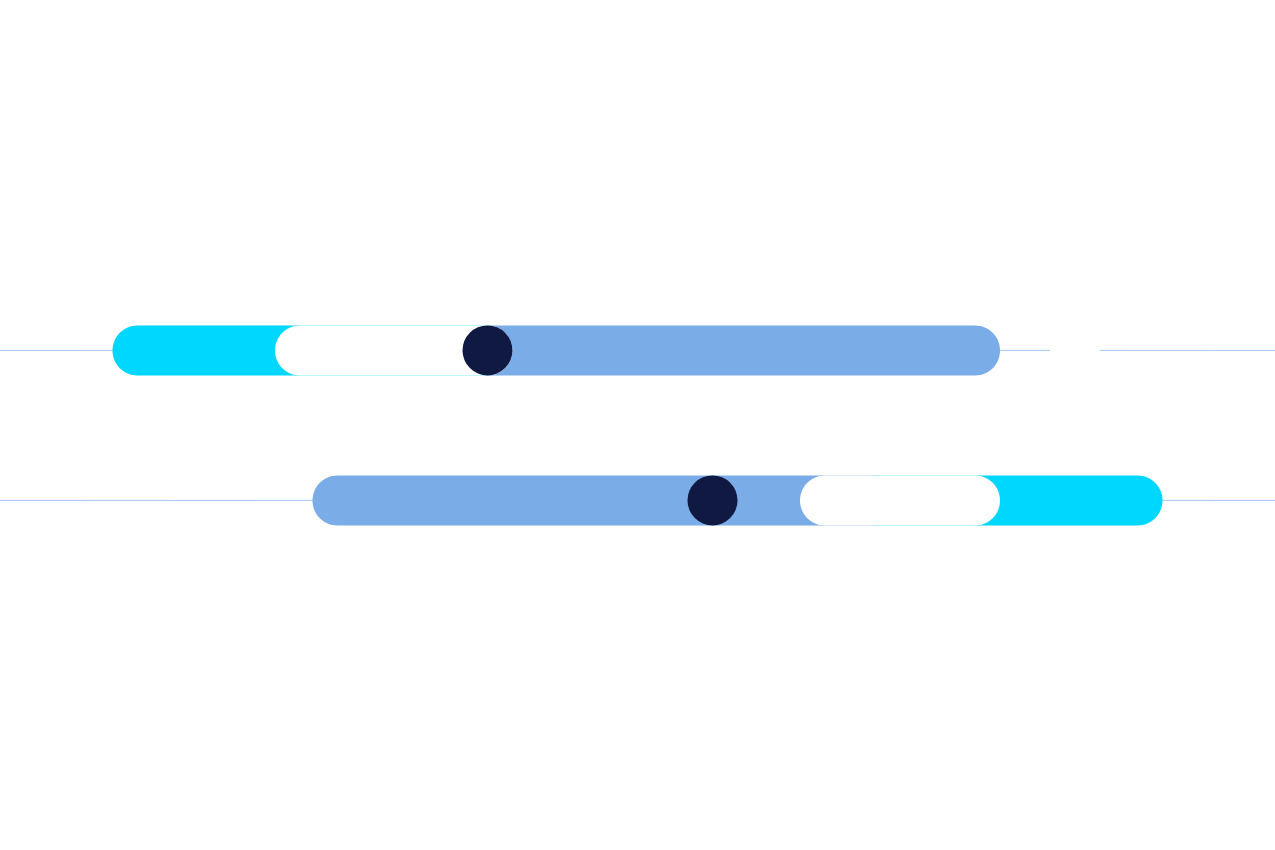

are you being paid what you're worth?

Use our tool to compare your salary with others in your field.

access our tooltypes of VPs finance (large enterprise)

Some of the types of VPs finance (large enterprise) include:

- corporate VP finance (large enterprise): as a VP finance (large enterprise) in charge of a company's finances, your duties include financial planning and analysis. You also manage the investment and financial obligations of the corporation.

- investment managers: as an investment manager, you work in banks, firms and other financial institutions. You are responsible for managing the investment portfolios of the organization. You analyze market trends and make investment decisions.

- treasury managers: as a treasury manager, you are responsible for the organization's cash liquidity. Companies or financial institutions rely on your expertise to ensure cash flow management. Your duties also include managing relationships with banks and evaluating debts and financing.

- risk managers: as a risk manager, you are responsible for evaluating and managing potential risks that affect the company's financial health. You develop risk management strategies, ensure compliance with regulations, and monitor financial performance.

- financial controllers: as a financial controller, you oversee the daily financial activities in the company. You supervise financial accounting and reporting by ensuring financial statements comply with accounting standards.

working as a VP finance (large enterprise)

If you are good with numbers and interested in working in finance, check out the duties and responsibilities of VPs finance (large enterprise).

-

what does a VP finance (large enterprise) do?

The specific tasks of a VP finance (large enterprise) depend on the company your work for. However, the typical duties of VPs finance (large enterprise) include:

- coordinating finances in the company: you ensure the company's finances are in order. This includes preparing and managing budgets and monitoring expenditures in the organization. You also forecast future cash flows and provide input on funding requests and investments. Since you oversee the finances, you analyze the accounting reports and ensure they comply with the regulations.

- analyzing the market: you have access to huge volumes of data on the company's financial performance. Your job is to study market trends and competitors, analyzing the data to identify business growth and expansion opportunities. If your company is involved with the stock market, you track trends and advise the management team.

- handling negotiations with banks: a business needs enough liquidity to meet its requirements. Your organization can raise funds through equity or debt. When acquiring financing from banks, you handle the negotiations and maintain the debt and equity ratio.

- allocating funds to various departments: as a VP finance (large enterprise), you manage a company’s funds. That means you make financial decisions from the distribution of funds to investment plans. You allocate funds to long-term and short-term assets and investments.

- compliance and regulation: since you are familiar with financial regulations and laws, you ensure the company complies with the legislation. You stay updated on the changing regulations and adjust the company's policies and procedures accordingly.

-

work environment of a VP finance (large enterprise)

VPs finance (large enterprise) work in diverse industries, from healthcare to banks and government agencies. Due to the diversity of business sectors, your work environment depends on the industry. In a corporate setting, you work in an office environment, attending meetings and collaborating with a team of accountants and other professionals. In a bank, you work in a branch or the corporate office, managing clients' investment portfolios. In a financial institution, you interact with clients and help them make sound financial decisions. The role involves travelling since you attend conferences and offsite meetings.

-

who are your colleagues?

VPs finance (large enterprise) collaborate with various professionals in the company. You are likely to work with accounting and financial experts, including financial analysts, accountants, accounting technicians and financial accountants. You also interact with marketing managers, human resource managers and operations managers. In a non-profit organization (NPO), you work with program managers and field officers.

-

VP finance (large enterprise) work schedule

The typical work schedule of a VP finance (large enterprise) is 40 hours a week. While you work the regular office hours from Monday to Friday, you sometimes work outside office hours. You meet clients for dinner to discuss investments or go with potential investors to play a round of golf. That means you occasionally work overtime or during the weekend. During the tax season, you are likely to work additional hours to complete your time-sensitive duties.

-

career opportunities as a VP finance (large enterprise)

The demand for VPs finance (large enterprise) in Canada is increasing, with a projected growth rate of 6% by 2031. That means you have promising career prospects. You join the accountant or assistant finance manager role before progressing to senior finance manager positions. Consider specializing in a particular area of finance, such as risk management, investment management or financial control.

-

advantages of finding a job as a VP finance (large enterprise) through randstad

Working with Randstad offers you a range of benefits.

- always a contact person you can fall back on and ask for help from

- many training opportunities

- a range of jobs in your area

VP finance (large enterprise) skills and education

To work as a VP finance (large enterprise), you require the following educational qualifications:

- bachelor’s degree: you require a bachelor’s degree in business administration, commerce or economics to become a VP finance (large enterprise). Most employers expect a master's degree in business administration, specializing in finance.

- professional certifications: you need several years of auditing and accounting experience. You should obtain professional certifications to improve your skills. Some financial management designations require a license in Canada. For instance, if you are a financial planner, you require a certification from Financial Planning Canada. Other certifications include Chartered Financial Analyst or Certified Management Accountant.

competencies and characteristics of VPs finance (large enterprise)

VPs finance (large enterprise) rely on technical skills and personal attributes to excel in their roles. Some of the skills you require include:

- analytical skills: having an analytical mindset is valuable for VPs finance (large enterprise). You rely on your analytical skills to identify problems and find solutions. Analytical skills are also useful in analyzing market trends and finding investment opportunities.

- leadership skills: you are a team leader who oversees the entire finance department. Your leadership skills are useful in delegating tasks and motivating team members toward reaching a common goal.

- communication skills: VPs finance (large enterprise) communicate and liaise with various people. For instance, you communicate with cross-functional teams, executive managers and clients. Good communication and presentation skills are important in order to break down financial information into understandable language.

- interpersonal skills: companies thrive on teamwork. As a VP finance (large enterprise), it is crucial to maintain good relationships with other employees. Be polite, empathetic and a good listener.

FAQs

Here, you will find the answers to the most frequently asked questions about the profession of a VP finance (large enterprise).

-

what is the role of a VP finance (large enterprise)?

As a VP finance (large enterprise), you plan, organize and control the finances of a company. You develop and implement financial policies in an organization and ensure they meet financial laws and legislations. Since you are in charge of planning, you budget the company's finances and make short-term and long-term financial goals.

-

how much do VPs finance (large enterprise) make in Canada?

As a VP finance (large enterprise), you earn an average salary of $130,870 per year. In an entry-level position, you start with a salary of $90,756 annually. With experience and educational qualifications, you make up to $196,772 yearly. The earnings depend on the size of the company you work for and your area of specialization.

-

are VPs finance (large enterprise) in demand in Canada?

VPs finance (large enterprise) are in demand in Canada, and finance-related occupations are projected to grow steadily. You can increase your chances of landing a job by obtaining the necessary certifications and gaining valuable work experience through internships or entry-level finance roles.

-

how long does it take to become a VP finance (large enterprise)?

To become a VP finance (large enterprise), you require a four-year bachelor’s degree and a two-year master’s qualification in a relevant field. Aside from educational qualifications, you should meet the experience requirements. While experience requirements vary depending on the employer, the minimum experience for most finance managers is around five years.

-

is being a VP finance (large enterprise) a good job?

VPs finance (large enterprise) are crucial to the growth of a company. Being a VP finance (large enterprise) is favourable and fruitful, particularly due to the diverse career growth opportunities and lucrative salaries.

-

how do I find a job as a VP finance (large enterprise)?

Finding a job near you as a VP finance (large enterprise) is easy. Search our job offers. Then submit your application using the ‘Apply’ button top right on the page. No jobs available right now? Send us your resume and we'll pass it on to a recruiter who will contact you if an opportunity opens up for you.

meet a recruiter

Make sure your resume is up-to-date, including information about your technical skills and certifications. Then share it with us to connect with a recruiter and be matched with job opportunities.