what is an actuary?

You will be required to be a strategic thinker and a problem solver in your position as an actuary. Your mathematical skills will be put to the test as you evaluate future events based on their probability and risk. As an actuary, you will use your skills to foresee the financial impact of risk events on your business and your clients.

Governments and businesses rely on actuaries to help them plan for future growth and unforeseen occurrences. Your skill set will allow your employer to face the rapidly changing world scene in a way that evaluates and mitigates risk. When you are hired as an actuary, you will be pivotal in helping your business navigate an evolving landscape.

use creativity to predict future uncertainty

You will be called on to use your creativity, adaptability and curiosity to guard against the potential negative effects of future uncertainty. Actuaries are involved in every aspect of a business, from planning to calculating pension plans to insurance premiums. You will be entrusted with managing financial assets and evaluating liabilities. Whether it is cybersecurity, data science or climate change, your input will be invaluable.

Would working as an actuary suit your skill or interest? Then read on to find out what competencies and qualifications you need to thrive in an actuary role.

actuary jobsaverage actuary salary

According to our latest salary guide, the median pay for actuaries in Canada is around $110,000. Actuaries starting in their careers may earn around $60,000, while the top 10% of experienced actuaries can earn $150,000 or more annually.

The work hours for actuaries in Canada are generally around 40 hours per week. When it comes to different sectors, actuaries working for the government can expect a median salary of approximately $105,000. In the insurance industry, the median salary is slightly higher at around $110,000. actuaries employed in the technology services, scientific, or professional fields have a median salary of about $100,000. For those in the management of companies and enterprise fields, the median salary is around $100,500.

According to data from Payscale Canada, an actuary's annual salary can increase significantly with experience over a 20-year career. It is estimated that they could see their salary rise by up to $80,000 or more during this time. As with any profession, salaries can also be influenced by the location of employment. In Canada, the top regions for actuarial work are Ontario, British Columbia, Alberta, and Quebec.

Moreover, the level of education can play a role in determining an actuary's pay. In general, having a master's degree in actuarial science is likely to result in a higher earning potential compared to having only a bachelor's degree.

It's important to note that the Canadian actuarial landscape may evolve over time due to various factors such as economic conditions and industry demands, which can influence salary trends and opportunities for actuaries across the country.

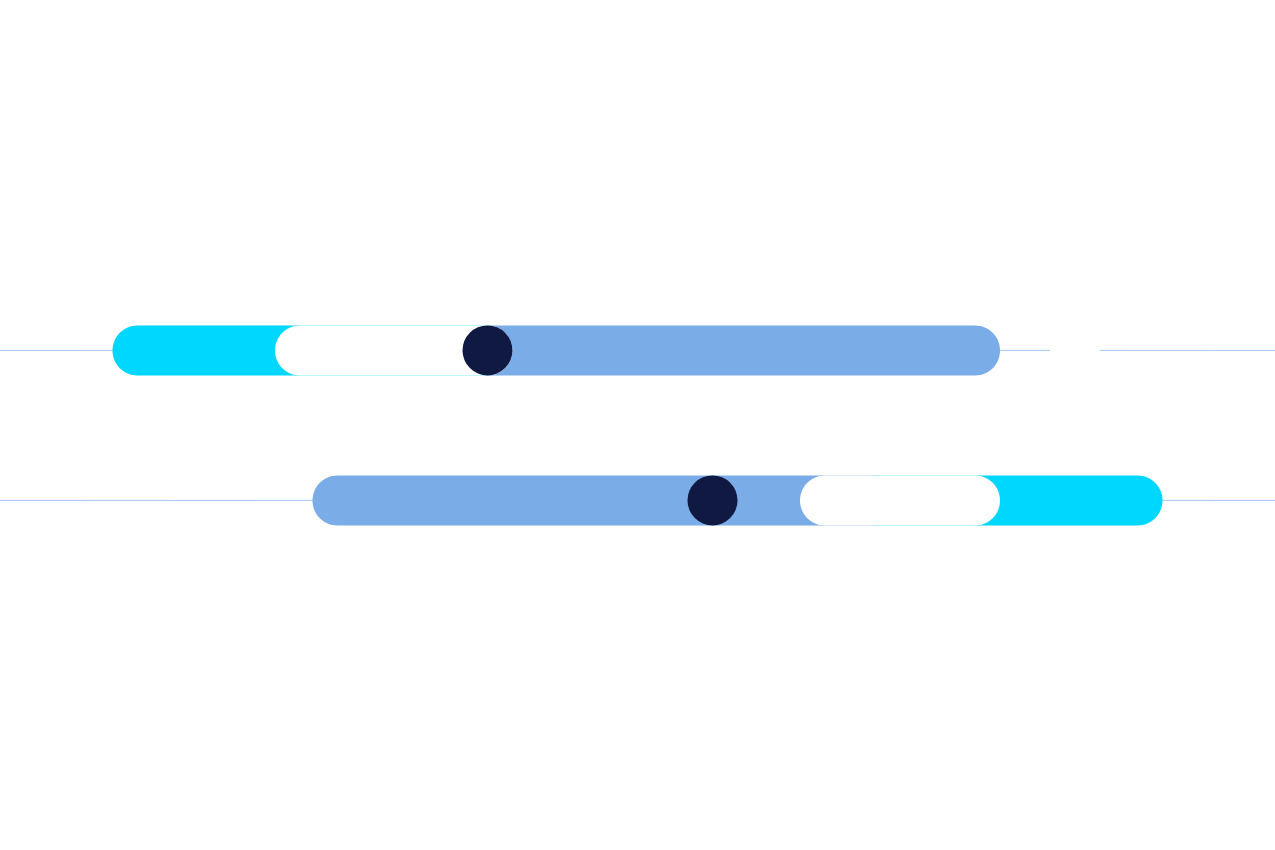

curious if you're being fairly paid?

Use our salary comparison tool by job title and region.

access our tooltypes of actuaries

- life insurance actuary: as a life insurance actuary, you are responsible for creating policies that cover groups and individuals. You will evaluate demographic data, life expectancy tables, risk behaviors and health.

- property and casualty actuary: when you work as a property and casualty actuary, your focus will be creating insurance policies linked to property loss and liability. This could include natural disasters, car accidents, fires and other types of accidents.

- healthcare insurance actuary: working as an actuary in the health insurance field means you will focus on estimating the likelihood that groups or individuals will need medical treatment. You will predict the cost of healthcare and determine what each policy will cover.

Other types of actuaries include:

- enterprise risk actuaries

- savings and retirement actuaries

- public-sector actuaries

- investment actuaries

working as an actuary

As an actuary, you may work for financial institutions, insurance companies, and consulting firms. Your daily tasks will vary based on your specialty.

-

actuary job description

Have you ever wondered, “What does an actuary do?” actuaries assess financial consequences of uncertainty and risk. You will use mathematics, financial theory and statistics to assess the risk of potential events. Clients will look to you to help them develop policies that minimize the cost of risk.

- analyzing data and creating strategies: most days, you will be responsible for analyzing financial data and then using it to recommend strategies. You will create reports and present data to executives or clients. Testing investment strategies and calculating risk is a big part of your daily work.

Your employer will require you to value insurance policies and make recommendations on how to meet regulatory requirements while balancing capital. As an actuary, you will have the rewarding task of being the person executives go to for help in making decisions that impact their financial well-being. - a position of trust and responsibility: you will be entrusted with keeping abreast of financial developments in the business world. Computer literacy is important since you will need to use computer programs to compile and analyze data. That data will be turned into tables, models, graphs and reports to display your findings. Other duties may vary based on the industry you work in.

- analyzing data and creating strategies: most days, you will be responsible for analyzing financial data and then using it to recommend strategies. You will create reports and present data to executives or clients. Testing investment strategies and calculating risk is a big part of your daily work.

-

work environment

Actuaries spend half their time working alone and the other half working in teams. The ability to work with others and communicate well with them is a key to success in this profession. The vast majority of actuarial work is done indoors in an office setting.

Most positions do not require much traveling, working overtime or working on the weekend. The exception is that consulting actuaries may need to do a moderate amount of traveling.

You can find work-from-home positions as an actuary. A challenge you may face when working remotely is figuring out how to interact efficiently with your reporting staff.

-

who are your colleagues?

Depending on your employer and the industry you work in, your colleagues might include a team of financial staff, including accountants, underwriters and financial analysts. You might also be working closely with financial and accounting managers and executives.

-

work schedule

Working as an actuary means that you will typically work between 40 and 50 hours each week. However, that can fluctuate depending on the circumstances. You may be asked to work more when there are project deadlines to meet.

Actuaries enjoy a good work-life balance. They usually have a flexible work schedule, allowing them to balance personal time with on-the-job training and their actual work. If you have exams to take, you can expect to be in the office about 33 hours a week, with between 10 and 15 hours a week of paid study time.

Most actuaries work full-time during the day from Monday to Friday. You might need to work nights occasionally to complete special projects or to study for exams. Part-time work is available for lower-level employees. These workers help senior actuaries until they gain enough experience for full-time roles.

-

job outlook

According to the BLS, the actuary job market is expected to grow by 21% by 2131. This is a lot faster than most other occupations. It is projected that each year until 2031, approximately 2,400 openings will be available for actuaries . Many of these jobs will be to replace employees who have left the labor market or transferred to accept other opportunities.

If you’re looking for a job with opportunities for advancement, then an actuary is the right profession for you. It is worth mentioning that there are several careers that align with your skills. You could be an economist, statistician, auditor, participate in academia, or become a writer on topics related to economic inflation. Your skills and experience could make you a formidable entrepreneur.

-

advantages of finding an actuary job through Randstad

Working with Randstad offers you a range of benefits:

- always a contact person you can fall back on and ask for help from

- many training opportunities

- a range of jobs in your area

actuary education and skills

If you want to become an actuary, it is important to have at least a bachelor's degree. Some professionals also have a master's or doctorate. The most direct path is to major in a study that includes statistics, mathematics and industry-related topics. Other majors can also produce well-qualified actuaries, like:

- economics

- mathematics

- statistics

- computer science

- physics

- substantial coursework in mathematics

You will want to focus on a major that focuses on business management, statistics, accounting or mathematics to be an actuary. Studying finance and computer programming can also help you get a job in this field. The more you know about topics like government and law, the better. You can improve your ability to communicate complex financial topics by including humanities, especially English, in your studies.

- personal development and continuing education

As an actuary, it is important to earn CE (continuing education) every year and ensure that you complete at least three CE hours on professional topics. You will be required to complete one CE hour on bias topics, six CE hours on organized activities, and not exceed three CE hours on general business skills topics.

- join professional organizations

When you join the Society of actuaries and the Casualty Actuarial Society, you can pursue associate-level certification. Although the American Academy of actuaries does not give certifications, it is a great resource for actuaries. The earlier in your career that you start the certification process, the better. You might consider beginning while you’re still earning your degree.

- pursue fellowship level certification

If you are an actuarial associate in good standing, you can pursue fellowship-level certification by obtaining the FCAS credential through the CAS or the FSA credential through SOA. If you opt for SOA's FSA certification, you will be required to select a specialty track.

skills and competencies

Some of the qualities of an actuary include:

- industry knowledge: as an actuary, you need specific industry knowledge to identify patterns and trends. For instance, if you want to work in finance or healthcare analytics, you require a background in the field. Familiarity with issues in the industry gives you an advantage.

- problem-solving skills: an actuary needs exceptional problem-solving skills to handle challenges during analysis. Critical thinking skills are also important to allow you to focus on the appropriate data and identify gaps in your work.

- communication skills: you make presentations to top-level executives and managers. You need exceptional speaking skills to communicate with stakeholders and managers. Written communication skills are also crucial for writing reports.

- technical skills: as an actuary, you need knowledge of database languages, spreadsheets and data visualization software. You also require skills in statistical methods to help you organize, gather and analyze data.

FAQs

Here, you will find the answers to the most frequently asked questions about the profession of an actuary.

-

what are the most common challenges of working as an actuary?

Actuaries must be capable of thriving in fast-paced environments where new challenges, like conflicts with stakeholders and changing requirements or business needs, constantly arise. Undocumented processes can become problematic when requirements differ for each person. The created specifications may also not satisfy the needs of the development team.

-

is it stressful to work as a financial actuary?

Financial actuaries typically work closely with their team in high-stress situations to meet constant challenges. The position can come with high levels of stress and long work hours, but it depends on the type of actuary and organization to determine how stressful work is day-to-day.

-

what are the differences between a business actuary and a data actuary?

Business actuaries evaluate an organization's problems through a business lens and emphasize industry trends. The work that data actuaries do is used to make business decisions, but their focus is more on the data.

-

what exactly do actuaries do?

As an actuary, you gather and interpret data collected by the company to find ways to improve processes and optimize revenue.

-

how do I apply for an actuary vacancy?

Applying for an actuary job is easy: create a Randstad profile and search our actuary job offers for vacancies in your area. Then simply send us your CV and cover letter. Need help with your application? Check out all our job search tips here!

meet a recruiter

Make sure your resume is up-to-date, including information about your technical skills and certifications. Then share it with us to connect with a recruiter and be matched with job opportunities.